Nobody likes the feeling of being judged and we all do our best not to judge others. While most of you may agree with this statement, is this the reality of the world in which we live in? Let’s use the mysterious world of credit to see if this is in fact the way things operate. Majority of institutions that offer some sort of credit will require that you have a “Credit Score” that falls in a certain range. You may be looking to open up a new account with a cell phone or cable provider and in-order to do so, you need to be above a certain credit score threshold. You may be looking to get a line of credit or a credit card and guess what, you need to have a specific credit score for your approval. Or, you’re looking to get that new car that you’ve been eyeing for quite some time and yup, you guessed it, you still need a certain credit score! What is this score that everyone thinks so highly of and is it identical to a credit report?

As per Equifax, one of the largest consumer data centres who store almost everyone’s credit information, a credit score is a three-digit number between 300-900 which is designed to represent an individual, or company’s, credit risk and is calculated based on the information stored on your credit report. Your score that is generated is composed of countless different variables that is a fragment of a complex algorithm that is used to determine how risky you are as a consumer or, in simple terms, how likely you are to pay back your debts. The lower the credit score the more “at risk” you are which will limit your options when it comes time to apply for credit. On the other hand, the higher your credit score, the “lower risk” you are which means you may have access to more options when applying for credit, ultimately reducing the cost of your borrowing through lower interest rates.

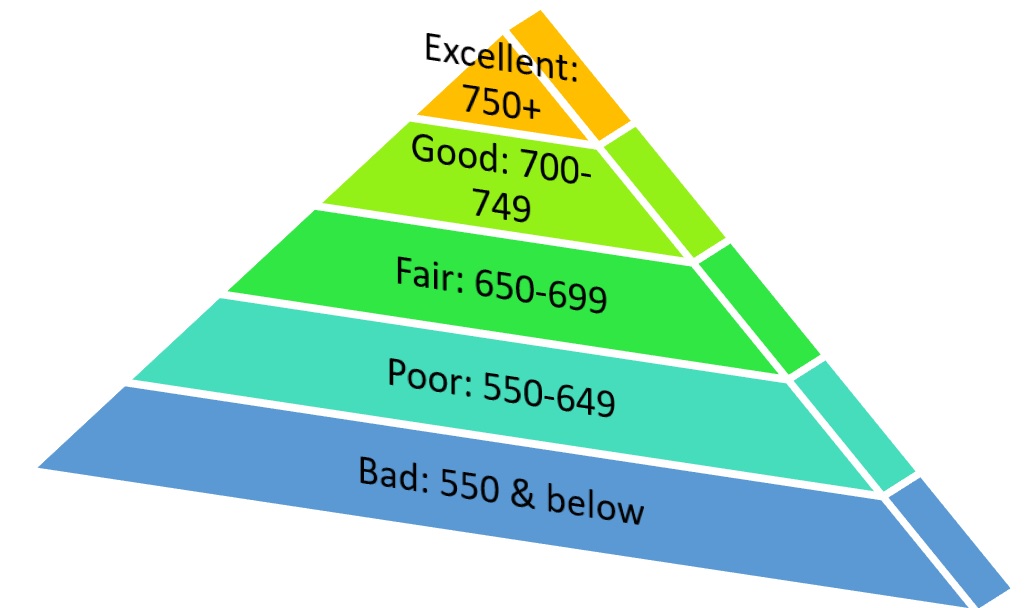

While there does exist some discrepancies regarding the particular risk levels associated with credit scores, the following is an example illustrating risk levels associated with credit scores:

Each of these scores reflects the “risk” category you are and will give you a picture as to what your options are in the world of credit. However, do not be discouraged if you are on the lower spectrum of credit scores because some lenders, such as Magical Credit Inc., look beyond your credit score and instead, look at your entire Credit Report. So, what exactly is the difference?

Majority of all trades gets reported to either Equifax or TransUnion, the two largest credit bureau databases. A “trade” is essentially any form of credit you currently have which requires you to make a from of payment, such as revolving credits or one-time payments. For example, say you have an installment loan with a balance of $10,000 and each month you need to pay $200 towards your loan. As long as the credit company you borrowed from reports to a credit bureau, and as long as you make your payments on time, you will have a positive report for that month, or an I1 rating. If you are late on your payment, you will then be reported as a late payment, or an I2. If you continue to maintain your delinquent payments, you will then have negative trades on your credit report. This information, although reflected in your credit score, will show up on your credit report as well.

Any company that reviews your credit report and does not pay attention to your actual credit score, will see whether or not your trades are currently in a good or bad standing. As long as your payments are on-time, even if you have a low credit score, you may still be eligible to qualify for the credit you are seeking out. In-other-words, if your credit is not that great, you may want to seek out companies that do not have a minimum threshold credit score requirement but instead, look at your overall credit report to see if you can be approved for credit. So, for those of you that like to look beyond a number and feel that you should not be persecuted for your past mistakes, seek out a company, such as Magical Credit Inc. who looks well beyond credit scores and tries to approve you based on your current information. Don’t lose despair just because you may not have the greatest score because there are those out there who don’t judge you on numbers alone but rather look at your entire situation to help you out when no one else will.

By Gregory O’Connor, Financial Advisor